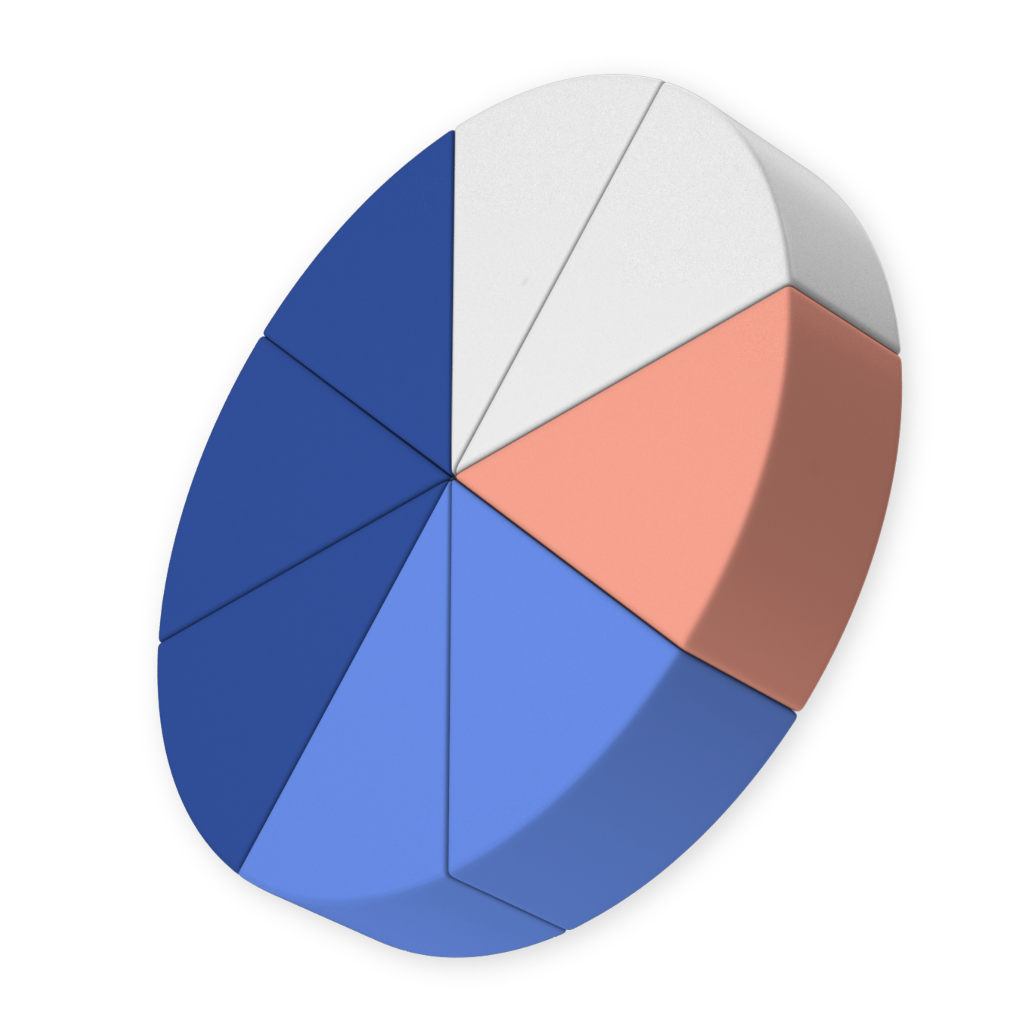

Multi strategy portfolio

Multi strategy approach provides the necessary diversification in a rapidly changing digital markets. It gives our portfolio managers the flexibility to allocated capital to the best performing strategy during different market conditions.

Portfolio alocation

Portfolio managers utilize active management and deep market understanding, coupled with quantitative analyses, to allocate the appropriate amount to the right strategy at the right time.

Spot strategy

Futures Long Short strategy

Market Making strategy

DeFi strategy

Arbitrage strategy

47%

Annual Return

Key terms

| Cumulative Return | 7,77%* |

| Annualized Return | 2,84%* |

| Volatility | 23,00%* |

| Sharpe Ratio | – %* |

| Accounting currency | EUR |

| Minimum subscritption | 100 000 EUR |

| Administrator | Bolder Fund Services (Netherlands) B.V. |

| ISIN | NL0015000PF6 |

| Risk profile SRRI | 5 |

| Entry Fee | 3% |

| Perfomance fee | 25% with a HWM |

| Management fee | 2% p.a. |

| Early exit fee | 1% |

| Fund manager | Richfox Capital Investment Management B,V, |

| Independent Auditor | Deloitte |

| Regulatory Framework | AIFMD |

*The calculations are based on monthly returns, whereas from Jan-2021 to Dec-2021 the returns are based on simulated backtest data and from Jan-2022 to May-2023 the returns are from live account NAV. CAGR is calculated from monthly returns. Volatility is calculated as annualized standard deviation of monthly returns. The risk-free rate for the Sharpe ratio calculation is 3.5% (yield on 10Y UY Treasury) over the period. The performance quoted represents past performance and does not guarantee future results.